-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

Thanks for the reply. ILLMAS that is what I thought too. I pulled the client's transcript through e-services and it shows the reduced refund but nothing else. No indications of them automatically returning the refund. The ITIN was renewed the summer of 2019 so six months has passed. I guess maybe the best thing to do is call the practitioner priority line to see if they show anything regarding issuing the refund.

-

First, wrong time of year for this type of stuff. But.... one of my client's had their 2018 refund reduced due to an expired ITIN. The IRS declined the child tax credits for three dependent children and the additional child tax credit as well. The ITIN has been renewed. Can we amend the 2018 tax return to obtain the reduced refund?

-

I have and hate it as well. I have one client now using QB Enterprise and not the online crap. They cannot share with me, their accountant, or send me an accountant's version unless I purchase my own copy. Thanks QB, I pushed them into this crap and shot myself in the foot at the same time. The payroll program???? Way too much, QB Pro-Advisor??? When I got out it was up to $800.00 per year. Well I guess one thing might be good, the client using Enterprise wants me to make office visits most likely quarterly. What I will charge them may cushion my frustration a bit.

-

I didn't think there was a clause for land only rental in QBI. Real Estate Rental Activities is what is in question to qualify for QBI. Nothing I read stated there must be a building on it. Now I agree for just land how could the 250 hours be met? That would be a tough sale. JMHO

-

If your client has. Bursar’s statement and receipts beyond the 1098-T. You can include those amounts in the total tuition and expenses paid. Just remember to deduct any room and board. Advise your client to keep those records handy as this is an area being heavily scrutinised by the IRS. Also, you can only claim 2500.00 for the AOTC. Pacun’s suggestion is worth looking at as well.

-

My main concern as I stated in the OP. No legitimate expenses. Doesn't have proof of anything. How do you justify QBI deduction when it is not a qualified business. No profit motive or anything else to prove it is a business. I am contacting Drake to see if there is a way to turn off the QBI on schedule C. As of this moment, I haven't found the check box if there is any. This guy asked his employer repeatedly about withholding the taxes so he knew something wasn't right. Yes, I'll approach him with the consequences of filling out the forms. He stated that this venture wasn't working very well for him. No benefits, no withholdings, and he feels the gross pay reported on the 1099 is wrong. It is his fault if he didn't keep the pay stubs or copies of the checks. He has done so this year cause he smells the rat. To me, and I may be wrong, but filing the Sch C is wrong.

-

I agree totally. I am one of those users from the past that tried at least three resellers and will never go back again. The full price of Drake is well worth the investment. Support is phenomenal and after using Drake for the last 4 years, I spend zero minutes/hours trying to figure out why something isn't working. When ATX was Sabre, I thought that was the best ever and rightly so until the CCH take over. I realize that sometimes the size of the business dictates the amount needed to spend on software so look at all of your options.

-

Correct, and if I remember correctly that is done with the 8919.

-

Client presented a form 1099 MISC showing a substantial amount 20k+ in box 7 that was hand written. After lengthy discussions with the client (a good client for the last 10 years) it is clear to me the client was indeed an employee and not a subcontractor. The client revealed the amounts received were paid based on an hourly rate working 8 hours per day. After hearing this, no additional discussion needed to determine the client is an employee. My recommendations are for the client to complete form SS-8 along with form 8919 and report the income on line 21 as other income. If this income is put on Sch C, QBI is generated, no allowable expenses, need business code; etc. The client performs HVAC services for an individual who claims he sub-contracts for another company and is not in the business of doing so for a profit and there is no profit motive. The individual is listed with the NC SOS as a legitimate LLC started in 2018. My client is not in the business of performing HVAC installations and repairs. Therefore he is not running a business as identified in sec 162. Now for the real kicker. From this point forward the individual is the "Employer". The employer, deducts a paperwork fee of 4% and the amount in box 7 of the 1099 MISC is the total amount including the so called paperwork fee. Another co-worker has stated that heir preparer claimed the paperwork deduction, mileage and other business related expenses. I told my client they are being ripped off by this guy. I showed them the benefit of the employer to do so. Now, this client is one of a family of clients that I prepare taxes for and I don't want to take the risk of loosing the whole family. However, I told the client I could NOT in good faith and conscience complete this return in any other manner. It would be unethical and I would suffer dearly. I'm open for opinions, would any one handle this any differently????? Yes, I told my client what the consequences of completing the SS-8 and 8919. Not sure they are 100% on board yet.

-

trust now owns the Sch E rental property - who reports

Terry D EA replied to schirallicpa's topic in General Chat

This is interesting, I read an article where the taxes in an irrevocable trust as at the grantor's tax level and not the high level of the trust. Because this trust is irrevocable, I now am leaning toward Lion's answer knowing the trust has to file a tax return. -

trust now owns the Sch E rental property - who reports

Terry D EA replied to schirallicpa's topic in General Chat

Even though the trust now owns the rental house, all income and expenses are reported on the individual taxpayer's return on Sch E as normal. -

Another reason I am glad I left ATX. That's ridiculous to charge if the OP paid for unlimited e-filing when they bought the software.

-

>>>>>>In looking over the mess, what they actually have is a sole prop with a consultant (the buddy). I now have a POA for the whole mess. My thought is to re-file (amend) the p'ship return as calendar year, all zeros, marked "initial" and "final" and amend the personal return to include the Sch C. Explanatory statements for both to be attached. <<<<<< Catherine, this was my initial take that this should have been a disregarded entity and I see you caught that. It sounds like your method will work and hope the explanations are actually read and understood by someone in the IRS. As Margaret said, I hope you get paid well on this one especially at this time of year.

-

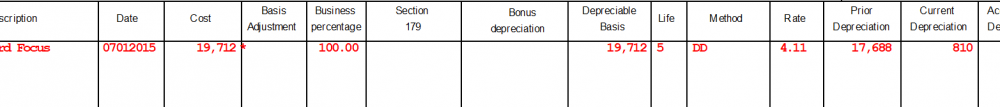

I ran it in Drake cause I'm too tired to do it in a spreadsheet right now. However, your calculation is correct. I can't answer why ATX is different. Did you do this as a listed vehicle with limitations under 6K lbs? Just a thought. I tried that in Drake and it returned a different value than ATX. Take a break and come back later and double check your entries. If they are correct, I would be calling ATX and overriding if you can.

-

Don't think so but not 100% sure. Ring (door bell camera) has now gone to the two factor authentication which is supposed to eliminate any hackers. I do have just the ring door bell which no one can look in my home only the front sidewalk and yard.

-

Itemized deductions can be allocated to each spouse and there isn't a requirement for a 50/50 split. If one spouse has an expense that is theirs, then that spouse should take the full deduction. If one spouse itemizes the other will have a zero standard deduction and therefore it is in their best interest to itemize as well. In your client's situation, why couldn't they file MFJ and the spouse without the tax bill file form 8832 injured spouse? That way her portion of the refund will not be used to pay his tax bill. This may benefit both. I would work it both ways and show them each so they can make a decision.

-

Got a notice today from Ring Central that my fax charges will be going up once again. This increase will not put my annual fees at $215.88 which is an increase of $56.88 from last year. I send and receive less than 50 faxes per year. With all of the secure file transfer programs I will probably even fax less. So, I'm looking at "MyFax" which will save $114.00 per year and I will be able to keep the fax number I've had since 2007. Ring Central has been flawless the entire time I have been with them. But the fees are too much for what I do. I expressed my concerns with Ring Central and it appears it will fall on deaf ears. Any suggestion on any other online fax services.

-

I think the available for rent to begin depreciation is at the time of when the property is first placed in service. Example; property was purchased in August, and repairs were necessary before the property is rented and it takes till November to complete. Depreciation begins in November. During idle time, depreciation and expenses like utilities and property tax are still claimed.

-

Thanks my thoughts exactly. Just needed another opinion.

-

Client bought four duplexes that are the same size and located on separate lots beside each other. Client paid one price for all four buildings and land. My first thought is each duplex is a separate rental enterprise with it's own income and expenses. Because these are all the same size and the county has the land listed at the same value, would you divide the total by four to arrive at the depreciable basis?? Personally I think this is best if the client ever decides to see just one unit/duplex. Opinions please.

-

If you are talking about different tax years. Yes, you can change from mileage to actual expenses. I assume your client wants to do this due to the depreciation that can be claimed on the new vehicle. Always run it both ways to see which method is best.

-

They are, this was verified with the employer as well.

-

Just completed one of these where the daughter inherited the house. So, the daughter's basis is FMV at date of death. I agree the children's basis is the mother's basis plus any improvements.

-

Thanks for confirming my thoughts.

-

I too did this one time. After that, I employed this anal method. I purchased numerous boxes of Hefty jumbo zip lock bags. Each client that drops off gets a zip lock bag. I place a post-it-note in the bag with the client's name on it. Once the return is complete, the docs and the return are put right back in the zip lock bag to stay until the client picks them up.