-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

I haven't used ATX for years so I can't answer. Drake does have a scheduling program. I don't use that either. I schedule all of my appointments through Square appointment. I have a booking button on my facebook page and plan on putting it on my new webpage. I don't have a secretary to schedule appointments and this helps so much. It also connects with my google calendar. With this said, Drake might do all of that, but I have not had time to try it. Square is free as well. JMHO

-

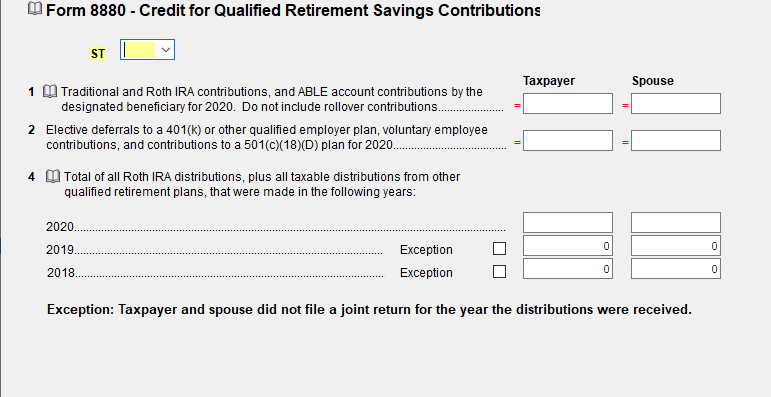

If this is the input you are asking about, The only information you have to input is the items on line 4 if any. The contributions made by the employer is input to this form from the W-2.

-

Yep, I totally agree. I have a self-employed author that files a Sch C each year.

-

So deeply sorry for Rita's loss. Prayers of comfort for her and her family.

-

Rental w/ deprec & debt transferred to existing partnership

Terry D EA replied to Terry D EA's topic in General Chat

Judy, Thanks so much for the info. I will review the links in your last message. I just learned from the partner that he did not transfer four properties but only transferred two into the partnership. The reason the transfer of the remaining two properties did not take place, they are mortgaged and the bank wouldn't allow it. So all properties this partner has moved were paid for so no worries on the affect on the basis or gain recognition. The same partner has created an additional LLC for asset protection as recommended by his attorney. Those properties are also clear. Even though this LLC is a disregarded entity, I will still track his basis in the LLC. -

Rental w/ deprec & debt transferred to existing partnership

Terry D EA replied to Terry D EA's topic in General Chat

Here is an excellent article regarding transfer of partnership interest. I know some folks here don't like clicking on links but this is too much to copy and paste. Transfer of Partnership Interest, Tax, Sales, Disguised sales and terminations -

Rental w/ deprec & debt transferred to existing partnership

Terry D EA replied to Terry D EA's topic in General Chat

I agree with no step up in basis. Maybe the words "step up" were used in the wrong context. Here is what I found so far which answers the majority of my question 26 U.S. Code § 723.Basis of property contributed to partnership U.S. Code The basis of property contributed to a partnership by a partner shall be the adjusted basis of such property to the contributing partner at the time of the contribution increased by the amount (if any) of gain recognized under section 721(b) to the contributing partner at such time. 721(b) is relating to intangibles, not applicable in this case. The only way I see the partner(s) will realize any taxable gain on the transfers is if any of the contributed properties are sold. I am sure, in this case, the other partner is aware of this. -

Client has four rental properties that have been claimed on Sch E. Transferred the properties into an already established LLC that is a partnership. Deeds and mortgages all transferred legally. For depreciation purposes, is the LLC basis for depreciation the contributing partner's remaining basis? All of the income, expenses, etc. are split between the personal return and the 1065 based on the date of transfer for the partner who is contributing the properties. I know this affects his basis in the partnership as well. I'm just drawing a mind blank right now on the depreciation issue. Thinking through this, if the LLC could step up the basis, wouldn't that mean a taxable gain to the partner contributing the property?

-

Well I know a lot of teachers in certain states do not have unions. In NC teachers do not. We have the NCAE which is useless and is not a bargaining unit for teachers. You confirmed my thoughts exactly.

-

I have not found anything on this subject yet. I have a few teachers and others that have been working from home due to the pandemic. If this deduction were available, wouldn't be under form 2106? That form is only available for certain folks to use. I don't see any other way this could be done. Thoughts???

-

I also checked Pub 970. The exact wording cbslee posted is correct and very straight forward.

-

Client has been claiming the AOC for education for the previous four years, started a consulting business in 2020 as a single member LLC. Now wants to deduct the education expenses incurred in 2020 as a business expense instead of utilizing the Life Time Learning credit or tuition and fees deduction because their income level is too high for the education credits. I have never been asked this question before. My first response was no because the education expenses were not continuing Ed or necessary CEU's to maintain a current status. According to the client, the education applies to their current credentialing. I have prepared this client's taxes for several years and this has never come up in the past. Business expenses were given to me from receipts they were pulling up on their phone. I couldn't see the receipts and some of the expenses seemed unreasonable. At times, it appeared figures were being pulled out of the atmosphere. I advised that all expenses have to be reasonable and allowable expenses and that you just can't create an expense. I also advised that because I now became suspicious of the legitimacy of the expenses, I was ready to terminate the agreement and send them packing. Not quite that harsh but you get the point. At this point I was shown some receipts. I included all of this in statements with the due diligence because there is a dependent child involved and CTC. I still say no regarding deducting the education expenses as a business expense.

-

I am a teacher by day. I can tell you that the majority of us spend far more than 250.00 per year. Many of us have purchased equipment necessary to work from home during the pandemic and for that reason alone have spent more the 250.0. Needless to say, the limit on that deduction is a joke and really makes little difference in the refund or amount to pay. While I love my teaching job, it is a thankless job at the same time. I could go on and on about this but wouldn't do anyone any good.

-

Health Insurance Marketplace - parents and dependent on it

Terry D EA replied to giogis245's topic in ACA

Again, I totally disagree. I did indeed have the parents permission to allocate the way I did. I did not state that which is why you took it that way. In my case the dependent got the letter and not the parents and the letter did not indicate his was not a dependent. I don't see how getting the letter automatically removes the dependency as you state. -

Can mom claim HOH status for 20 year old son but not him?

Terry D EA replied to giogis245's topic in General Chat

I agree with Lion we need more information here. The mother can claim the son up to age 24 if he attends college full time. The original OP stated the son attended part time which I agree will knock her out of claiming him as a dependent which negates the HOH as well. By your figures of the son's income, it appears he should file on his own. I always do this both ways and compare it to the parents return both ways and determine the best scenario for everyone. -

Health Insurance Marketplace - parents and dependent on it

Terry D EA replied to giogis245's topic in ACA

I disagree. If the daughter is a dependent and is included in the parents insurance in the market place, the allocation is to determine who gets the premium tax credit and who pays back the excess. I had this same scenario last year. I allocated everything to the parents and zero to the dependent child. So, on the parents 8962 allocate 0 and the dependent child allocate all to the parents and yo should be fine. -

We went to PA to do some things for our daughter on New Years weekend. At that time, PA wanted you to have a 72 hour negative test report with you when you entered the state. Wondering how they would ever enforce this, we traveled anyway. No one stopped us at the border, (WV and PA rt 79). Naturally, Lowes Hardware was open but no restaurants; etc. Hotel never questioned anything. That is all I know.

-

I pay $396.00 for 1M coverage thru Hiscox as well. Never had a claim in 24 years either but as others have said, can't be without it.

-

The worksheet you speak of is used to determine if the taxpayer is due any additional impact payments based on what he/she has already received. I do have a few clients that never received their stimulus payments. This worksheet is used to obtain the payment they should have received but didn't

-

Those of us who have been in this business for a while should very well know the IRS will never call you to check on anything or verify anything. As soon as I would get this call, all the red flags would immediately soar.

-

For those Drake users, the organizers are a breeze. There is also an option to create fillable pdf's. This is the first year using the Drake portals to send and retrieve the organizers. I feel confident that as long as the client's understand how to use the portal, which most do, getting them back will hopefully be trouble free.

- 1 reply

-

- 2

-

-

Thanks for the heads-up. I will get it installed later this afternoon.

-

Update: I have been using zoom as a teacher since last spring. I did speak with a zoom rep today and asked about the security or encryption for both video and audio. They stated they are very secure with both items and each it encrypted. My concern was using the screen share and who could hack into it. I have also used Webex. Webex, does have some glitches. When I use Webex on one of my machines which is a Win10 Pro with all of the latest updates, Webex knocks out the audio and all of the audio settings get changed and I have to reset them. So, I'm now thinking that zoom maybe the better way to go. Zoom has a free platform that still has the same encryptions as the paid version. The only difference is number of hosts allowed and meeting length. The free version is 40 minutes and the paid subscription is 24 hours. Hopefully, this will be a good way to meet with clients during this pandemic and very well may entice new business.

-

Okay, I love the discussion on this. To address what Catherine has said, yes I reviewed the conversions from the IRS with the client via telephone. I offered a brief written summary as JohnH suggested. The client said there was no need. After an hour or so had gone by, the client then asked for not only the summary but wanted me to add to the summary that I ask their tax preparer advised them to ignore communications from the IRS regarding this case. That I never did and only repeated what the IRS agent stated. That is what has raised the suspicion on my part. Also, that gave me the rear tire feeling from the bus. Now, after all of this, I am considering again what JohnH suggested to give the summary without anything that indicates any input from me. Maybe that will satisfy the client.

-

No not at all. That is what I am trying to avoid. The only thing I plan on giving is the opportunity to seek help from someone else. I know I've done nothing wrong at all but I don't need them making something out of nothing. Never put anything in writing that could even remotely put a rope around your neck.