-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

I have a client coming in this afternoon that has not received their 2019 refund. The only thing I can come up with is to have them sign a POA, and call the PPL and keep my fingers crossed they actually take the call and look into it. This client said they called the IRS and they were told there was a place on the 2020 1040 to claim the lost refund. I mean really??? I told them they had to be talking about the recovery rebate credit.

-

1099C on car that was returned under lemon law.

Terry D EA replied to schirallicpa's topic in General Chat

>>>>>>This guy claims the 1099C debt was for a used car that he had purchased 5 years ago and returned to the dealer claiming lemon-law.<<<<<< I'm wondering if all of the debt was forgiven or a portion there of. I would tell this guy he is on extension until he produces the paperwork to substantiate the terms of the lemon law details and give him a bloated price or send him packing. Here is some useful reading. If it were me, I might send this guy packing. These two excerpts may answer some questions. The link to this info is Used Car Lemon Law Questions and Answers | New York State Attorney General (ny.gov) While this is from New York, I would feel reasonably certain the law is similar in most states. WHAT IS THE PURPOSE OF THE USED CAR LEMON LAW? The Used Car Lemon Law provides a legal remedy for buyers or lessees of used cars that turn out to be lemons. The law requires dealers to give you a written warranty. Under this warranty, a dealer must repair, free of charge, any defects in covered parts or, at the dealer's option, reimburse you for the reasonable costs of such repairs. If the dealer is unable to repair the car after a reasonable number of attempts, you are entitled to a full refund of the purchase price. No used car covered by this law can be sold by a dealer "as is." (A copy of the law may be found at the back of this book) IF THE CAR IS FINANCED, HOW IS THE REFUND DIVIDED? The refund by the dealer is the same whether the car was financed or not. However, when the car is financed, instead of the entire refund going to you, the refund is usually divided between you and the lender (the bank or finance company). Generally, the lender will calculate how much is still owed by you and apply the refund to that amount. The balance of the refund will then go to you. If, however, the amount you owe the lender is more than the refund from the dealer, the dealer must notify you in writing, by registered or certified mail, that you have 30 days to pay the additional amount owed to the lender. The notice must also contain a conspicuous warning that the failure to pay the additional amount to the lender within 30 days will terminate the dealer's obligation to provide a refund. -

Confused...Recapture Depreciation....Rental Property

Terry D EA replied to M7047's topic in General Chat

The responses you have received are correct. I just completed one of these scenarios. Below is an example from the Journal of Accountancy. Disallowance for use as a nonresidence. If a taxpayer also uses a home for purposes other than as a principal residence, the gain exclusion does not apply to the extent of depreciation taken on the home after May 6, 1997. Example. On January 1, 1998, Kelly bought a home and rented it to tenants for two years. During the rental period, Kelly takes depreciation deductions of $14,000. On January 1, 2000, Kelly moves into the home and begins to use it as a principal residence. On February 1, 2002, after owning and using the home as a principal residence for more than two years, he sells the home at a $40,000 gain. Only $26,000 ($40,000 realized gain minus $14,000 depreciation) of the gain is eligible for the exclusion. Kelly must recognize the remaining $14,000. For purposes of IRC section 1(h), the gain is an unrecaptured IRC section 1250 gain. Make sure you report the depreciation gain using form 8949. When a rental asset is sold it is normally reported on form 4797. However, none of the gain will be excluded. -

The form for the daughter to sign to obtain he refund is form 1310. The daughter should be the estate representative, fiduciary, or executor that is appointed by the court.

-

Anyone happen to have saved a downloaded copy of OneDesk for 2014. Unfortunately, I have to admit I used this stuff in 2014. While I deeply regret it, a client would like to have a copy of his 2014 return. I have the backup file but not the program. I also have the entire computer backup but don't want to restore that.

-

1099R direct rollover from employer pension to roth IRA

Terry D EA replied to tax1111's topic in General Chat

This is the main thing that I agree with in this thread. The quote below is excellent advice as well. Also, never assume. Always verify with the client and have documented proof to support your position. As said in another thread, nothing is worth loosing a license over. -

early distribution penalty and tax on earnings

Terry D EA replied to tax1111's topic in General Chat

I think the early withdrawal penalty applies. Agree, no earnings or principal is taxable. OP said he was under 59 1/2 -

Only thing I can add to this is through Drake, I use Secure File Pro. Provides the same services mentioned here but comes at a much lesser price. I am billed $14.95 per month. For e-signatures, I have been using the free version of Pandadoc. Comes with a certificate of authenticity for the signature. E-signatures through Drake can be purchased as well. The cost would still be less than the other programs mentioned in this post.

-

Only have done a very few military tax returns over the years. I have a client who's son is in active duty with the Navy. During 2019 he receive form W-2 with box 1 and 2 blank. Box 12 has code Q which is combat pay. He has no other income from any other sources. I have looked at Pub 3 to find out if he has to file a tax return. All I have found, which I knew, that combat pay is excluded from taxable income. The W-2 does show amounts in box 3, 4 5 & 6. Question is does he have to file a return? If so, how do I get the return to be eligible for E-file with no wages on the W-2/

-

Thanks Catherine, No you're not. I'm right there with you. Only under my breath is the holy crap comment.

-

cbslee. I did not ask, they volunteered the information. As far as your other question, NC will recognize the common law marriage of a couple from another state as being legally married. I believe they do this because a precedent was set in the other state. I did read this but can't remember the exact wording.

-

New client. Never been married but has lived with girl friend for numerous years. They have two dependent children together. Previous tax filings have been filed using the MFJ status. NC is one of the few remaining states that does not recognize common law marriage or cohabitation as a certified marriage. As we all know, that IRS will follow state law regarding marital status in these situations. I have advised these folks that I cannot file their 2020 tax return as MFJ. Not sure how they want to proceed. But if they do stay with me, how many years should they amend the previous filings? Of course, they have the responsibility to do so and nothing in the past obligates me to anything. 25 years ago, this was addressed in an HRB tax preparer class. At that time, we were advised to do what the client said and stick your head in the sand. How would anyone here proceed?

-

Thanks Possi, I realized after I posted this that this property was indeed their primary residence for two of the last five year period prior to the sale. The client did their 2019 return on Turbo tax and for some reason they depreciated the property at 50% use. According to their records, the property was converted to rental in June of 2018 and rented for 365 days. I think they used the 50% business use due to renting the property of half of the 2018 year. The recapture of the depreciation won't be that much. But, it looks like 2019 needs amended with a 3115 to correct the depreciation. Folks don't realize the mess they can create if they don't know what they're doing.

-

Client purchased property on 12/14/2014, converted the property from personal use to rental 6/1/2018. Sold the property in December 2020. Isn't this out of the time window to claim the 121 exclusion on the sale?

-

I did read page 5. My wash sales are reported as required. I can attach a .pdf of the summary statement or any other parts in Drake as well. I really doubt that I could get anyone at Robinhood to give the 1099B in excel format. I would love it if they would.

-

Good reading material. There are wash sales but they are identified as disallowed. Thanks,

-

I have used QB in the past. For the most part it is not beginner friendly. But.. if the payroll is setup correctly and not too complicated with fringe benefits; etc. It does do a fairly decent job. PR tax payments can be setup for automatic EFTPS deposits, state deposits; etc. I agree with Medlin though, to start they should use a service.

-

It seems there are some previous post regarding Robinhood Securities and I apologize if I am beating a dead horse here. I do understand the transactions and do know where they go; etc. My client just brought in 52 pages of these transactions. If I read the top of the 8949 correctly, we can enter these transactions as a summary????? For me to enter each individual and group transactions will take about 2 weeks solid work. I don't think this guy can afford that. Yeah, I would love the final bill but really???? Proceeds of one summary is $385,093.75 - By the transaction dates, these are day trader transactions. BTW- he lost his butt on this.

-

I stand corrected on NC. NC always uses the Fed taxable income as a starting point. With that said, the exempt unemployment from Federal is also exempt from NC.

-

NC has not announced any changes yet and quite honestly, I don't expect them to. They always tax unemployment. The Drake update also corrected already filed taxes returns with unemployment compensation. There a fix in the works to correct this and we probably won't know until the IRS releases the guidance on how to amend those returns.

-

Guaranteed pymts vs draw. Anyone want to discuss

Terry D EA replied to schirallicpa's topic in General Chat

Because a partnership is a pass thru entity, aren't guaranteed payments subject to SE tax? Distributions, would seem to be a distribution of capital as the OP states?? The extra loads would definitely be guaranteed payments. It sounds like what the OP said the distribution title was used to avoid the SE tax. Too bad the agreement isn't more specific. -

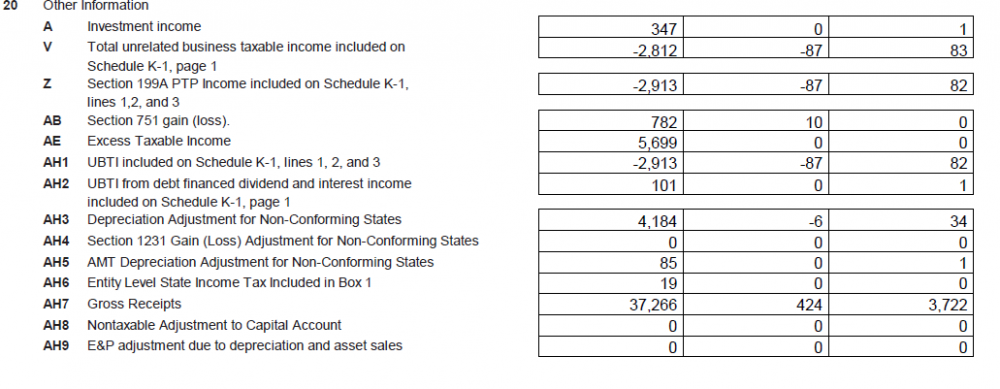

I do have that detail and it does tell me where to enter parts of it. For example, the 782 gain is supposed to go on form 4797 section II. I can't find the input for that. I did see on the partner's basis worksheet where an entry for 4797 part II but in Drake it was labeled a bit differently which throws me off a bit. There is no explanation for the gross receipts of 37,266. The AH3 depreciation adjustment for non-conforming states. Client is in Texas. I guess I'll check to see if Texas requires anything. I'm glad we're still waiting on another K-1 for this guy. Gives me some time.

-

Where is the information below entered in Drake? I can't seem to find anywhere to add the additional codes in section 20 of the partnership K-1. I looked into the K1-P as well and none of these codes appear to exist. The only code in the drop down is A. Help please.

-

Health Insurance Marketplace - parents and dependent on it

Terry D EA replied to giogis245's topic in ACA

I don't split anything nor do I make any decisions. It is up to the taxpayer and their dependent who gets what. I don't have time to list where this is in the Pubs but I do know you are only listing what both parties agreed on. You are affecting each persons refund or balance due by the percentage(s) each party agrees on. Sorry I can't explain it any better right now. -

Tom, The square appointments is easy to setup and is also easy to manage. During the setup, I set the hours that I am normally open for business. Also included in the setup are the services I offer and the time normally allotted for that particular service. I list whether it is a drop off, review and pickup, individual return, consultation, etc. None of my business clients use it nor any rental enterprise partnerships that I have. But, for individuals it works great. I can also block out a time when I'm not available for anything personal. Example; I have to go to my daughter's in Delaware one weekend. This will only be a two day trip over a weekend so I am only closing for one day. I don't take walk-ins only appointments and this works great. Client's can also pay through the square appointments. I don't use that feature cause I never know exactly what they are bringing me. Hope this helps. '