-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

This from the NAEA ALERT: New IRS Policy for POAs! We want to make all EAs aware that there is a new policy at IRS for powers of attorney (POAs) requiring three zeroes ("0's") to be placed in front of the enrollment number (000XXXXX) on form 2848. If the three zeroes are not included with the enrollment number, POAs are getting returned. As a result, we are encouraging all EAs to proactively include three zeroes at the front of your enrollment number on form 2848 POAs to avoid any processing issues.

-

I get it. In your example the 4000.00 if used on non-qualified expenses, is taxable income is legitimate because you used the bursar’s statement. My take on the other conversation was folks were randomly making part of the scholarships taxable income to get the credit without using actual expenses. I always ask for the bursar’s statement and have always done the 8863 this way and have obtained the AOC many times. However without the bursar’s statement, and only 1098-T in hand, I still find it strange to make a portion taxable income to obtain the credit. I read the pub on the coordination and it does suggest making some of the scholarships taxable income. I just thought it strange to do this without substantiation. Another question is, is the pub the authority in an audit? A few years back, A couple of my clients received letters from the IRS asking for proof of the college expenses beyond the 1098-T.

-

Ok, so I stand totally corrected and learned something. Thank you for straightening me out. The whole process just didn’t sound legit.

-

I read from another discussion board which will remain nameless, a method they called "Advanced Education Credit Strategies". This involves making a portion of the scholarships taxable income, when scholarship amounts exceed the expenses to make the client qualify for the AOC. Personally, I think it is fraudulent reporting and unethical and won't do it. Has anyone ever done this? All the training, CEU studies and other things I have done on education credits have never mentioned anything like this. Three or our people on the other board chimed in that they do it all the time.

-

Okay, took the dive and called The TaxBook. I purchased the Web Library Plus subscription. Because I purchased it now, they gave me 2021 and 2022 for $269.00. That was with the Drake discount. Normal would have been $319.00. They walked me through several research methods, and it looks fairly straight forward.

-

I didn't think of googling it at all. I'm just at a point that I don't want to spend money on research materials when it can be found for free. Through Drake the discount on the weblibrary plus is pretty good. I do like how it is integrated in the software, but I want to be able to justify the cost.

-

Thanks so much Judy, that is exactly what I was looking for. How did you find that so fast? I need to learn that.

-

Looking at the taxbook weblibrary plus. Comments or suggestions please

-

Looking for the best tax code research software or platform. I have the CFR 26 book marked. Looked at the CFR26 from Cornell as well. I'm trying to find the code references for the exceptions to early withdrawals from any retirement account. I go the pubs and form 5329 instructions as references. I'm preparing an audit review request for a client and need this supporting information. Apparently, I haven't used the proper wording in the search. I can find a ton of stuff on distributions from Roths but not from other retirement accounts. Any help would be appreciated.

-

According to Drake, these forms aren't finalized yet. Working on an S-Corp that has no foreign income, accounts, transactions etc. I had them sign a letter stating their position and to not prepare Sch K2 & K3. Does this statement have to be attached to the return or is it for our records.

-

Could, should maybe!! I'm looking into that. The main thing is the client is totally disabled and confined to a wheelchair and cannot work. Hence the reason for the distributions. Just a little SS income.

-

The 1099 is coded code 1. The issuing company stated they no longer use code 2 or 3 and the taxpayer is directed to indicate the exception on the 5329.

-

All good responses. Thank you!

-

Client is totally disabled and confined to a wheelchair and cannot perform any normal functions to earn any type of income and is 58 years old. Only income is early distributions from an IRA. H&R prepared their 2019 return which is under examination. H&R put the gross distribution from the 1099R on line 7 of the 1040 labeled income from 1099R. I believe they did this to avoid the early withdrawal penalty instead of filing the 5329 with code 3 as the exception. To me that was crazy and they need to absorb any penalties and interest. Has anyone done this the way H & R did? I don't even think it is proper at all. The IRS has added the 1099R as additional taxable retirement income and sent the CP2000. Bad news, client got scared and ignored the letters and has recently refused delivery of a certified letter from the IRS which I am assuming is the 90 day letter. Now, I'm on board to help. My opinion is to amend the 2019 return to include the 5329 so the return is accurate. Client signed 2848 so I'll try to get a status of the account and inquire as to where the IRS is in the collection process. Because the client refused to accept and sign the certified letter, are their rights to petition tax court still available or is the clock still running on the 90 days? Wrong time of the year for this, but.....

-

That is exactly the way I'm going to do this one. Thanks everyone.

-

The client statement that th esale wasn't for USD. But if it was other crypto, it is still a taxable event with either gain or loss as I understand it. Correct?

-

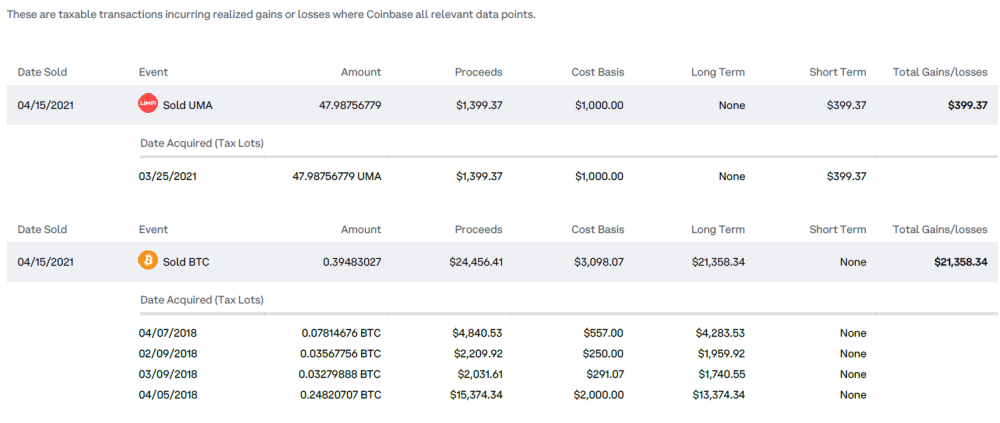

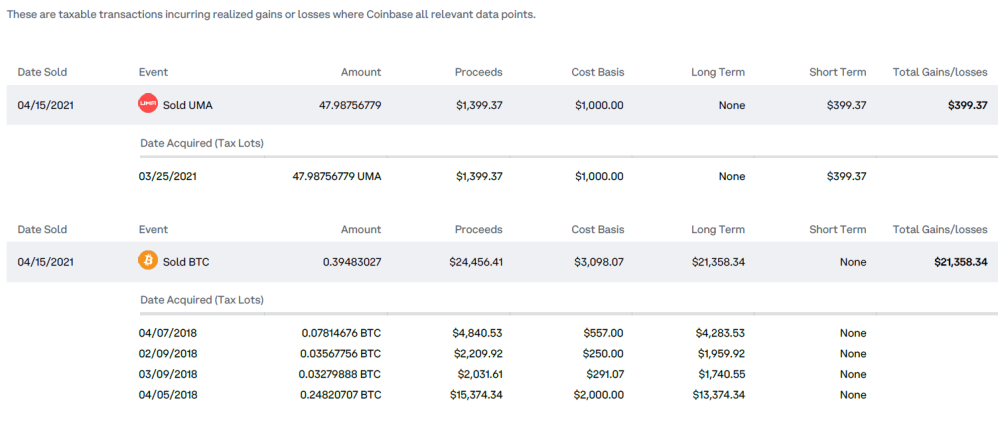

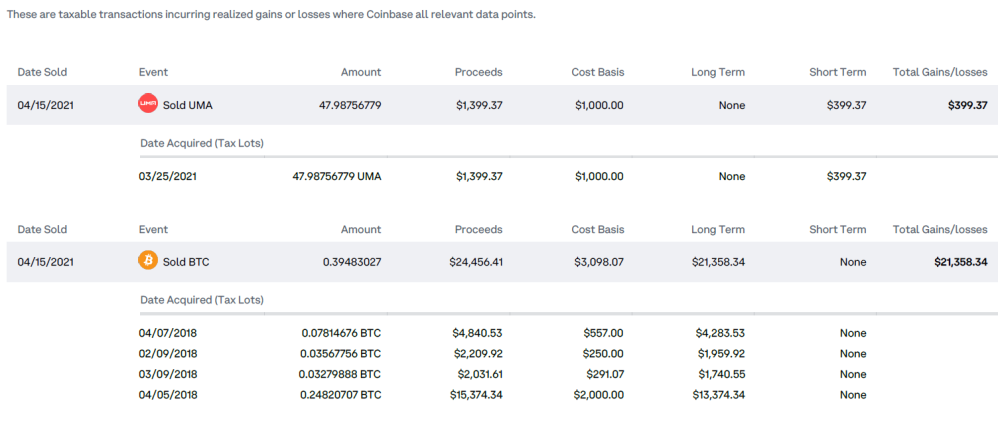

Looking for other's opinions. The following is all taxable gain????? The coin base doc statement in the upper left hand corner says so. Just because it does not say USD, it is still taxable. correct?

-

I'm just going to go with the return as it is and stop worrying about it. Yes, there is a small amount of EIC which does bother me. But I can't find anything stating you have to have expenses for self-employed income to qualify for EIC. If the IRS questions it, then so be it. I've done my research and have too many other returns to do so it's time to move on.

-

Gail, I did mention in the OP it was Consolidated 1099DIV. Drake support rep said to attach a pdf. I called to discuss the file upload template and was told the pdf was an option. Yes, I plan on using code M and MW as Abby suggested. The client is trying to get a .csv file for me to upload. But.... if it really isn't necessary, then I'll quite asking for it.

-

DITTO, this topic came up several times during my studies for the SEE Exam.

-

No on his own tools and when I asked about supplies he said he did buy some things but did not keep receipts and doesn't know how much he spent. I want to be real careful here. This person is a relative of another client (closely related). The other client pays for everything including the tax due so it is no big deal to this guy. There is a lot of additional detail I cannot give and I have to keep my personal convictions out of this and just prepare the return by the tax code. I did advise I would research further into the QBI which is a 1400 deduction and the guy was not concerned about the difference. Of course not, he's not paying for it. The more questions I ask the more he doesn't seem to care, shruggs his shoulders and says it is what it is.

-

My OP said 6 pages and I meant 60 pages totaling in 900K+ in transactions with numerous wash sales. Sorry.

-

Client gave me a 1099NEC with 21k income. He clearly is not operating a business. Claims he does welding and fabricating. All sounds as though he should have been a W-2 employee. Because welding and fab is a "Trade" does he still qualify for the QBI? I put the 1099NEC on Sch C. There are no expenses. The program is generating QBI correctly if he truly qualifies. He also qualified for a small amount of EIC. I'm just uncomfortable doing this when I know full well this in not a business venture. Opinions please.

-

Cient uploaded their information to my Drake portals. There is a consolidated 1099DIV form that is 6 pages worth of transactions. Normally, I would use the summary page instead of working for the next 6 months entering transactions but there are numerous wash sales. Can I still use the summary page or do the wash sales need to be reported separately. This is from Ameritrade and I am going to ask the client to see if they can get a .csv file for me to upload. Suggestions please.

-

I print everything and give it to them. My thoughts, they paid for it, it is their information, and they are entitled to it. I agree with Judy, I'd rather see a return with too much detail than one that has little.