-

Posts

4,620 -

Joined

-

Last visited

-

Days Won

26

Everything posted by Pacun

-

The suggestion above works if the Federal is the one stuck. In your case, you might want to keep both, the original and the copy 1 version because you will need proof that you efile and the federal will reside with the Original one and the state with the Copy 1 version.

-

Sorry, I misread your question. I sent about 10 returns last week and all of them got stuck. Open the return, pull down the file menu and select "duplicate return". Close the original return and stay with the "copy 1" return, create the efile return and send the federal. When the efile is accepted by the IRS, send the "copy 1" return to the state. Once both are accepted, go to efile manager and delete the original efile files for IRS and for the state. Then go to return manager and delete the original return. After that and while in return manager, delete the Copy 1 in front of your client and you are back to normal.

-

change your setting for a few minutes to DON'T hold my states. Recreate the efile file for the IL and send it to IL. Go back to your ATX settings and select to hold your state returns.

-

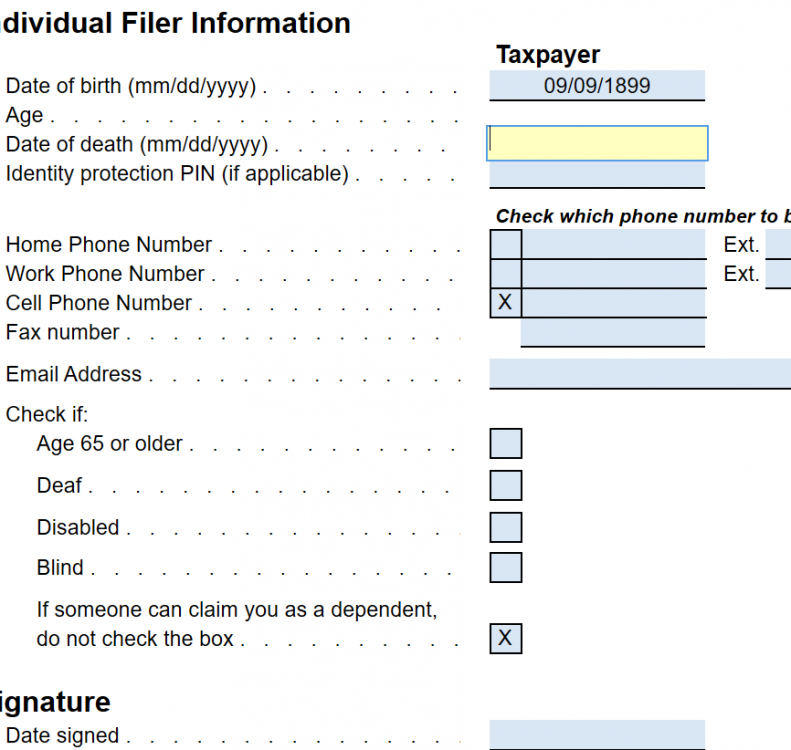

Part of your question is that prior to 2018, you could see when some was claimed as a dependent because you had two places to check. One was the check box "YOUSELF" on page 1 of the 1040 and the other place to check was page 2 when the personal exemption amount was 0 for dependents. Now those places to check don't exist and you have single for the dependent with the same 12K standard deduction. These are the resources you have at your disposition to check if the person is filing as a dependent: 1.- If you are doing the return for both supporters and dependent, efile the supporters return first making sure you are claiming the dependent. After the federal is accepted, efile the dependent. If you make a mistake on the dependent's return, the IRS will reject it. 2.- When preparing the dependent's return, make sure you take out the X as shown on my post above AND even if the dependent didn't have health insurance, check the box for health insurance. If you did it correctly, ATX will not let you create the efile until you uncheck the health insurance question. If the efile is created with the health insurance check marked, you are filing as single and claiming the exemption. 3.- When the efile has been created, read that ATX will read something like" (someone can claim this person as a dependent).

-

Filing a return is a different story. Yes, ANYONE is required to file a return if you have a 1099-misc filed correctly. That by itself doesn't change the rules of AOC. I start to understand why we have different answers. In my case both parents and students have W-2 and that's it and their livings standards are not of the Pacun tower. If you want to be more technically, ATX always want you to make the scholarships taxable so the student can take the refundable credit.

-

Thank you for all the explanations. I have seen this post and I didn't bother to read before. Today I felt bored and I decided to read and to my surprised, I have a client exactly in the same situation. I am glad I read this because I was second guessing myself and I have an appointment with the client tomorrow. I am surprised that my client's 1099-R doesn't show the contribution amount since they have had this account since its inception. If the title on this posting would read something like "How do I report this Roth IRA transaction", I would have read it a while ago.

-

Australians using QTP funds for Aussie college

Pacun replied to Margaret CPA in OH's topic in General Chat

If I am not mistaken, qualified higher education in the context of 529 means, bachelors degrees, and not technical schools. So as long as the dependent is going for a bachelors, I believe it should be OK and the money shouldn't be taxable. -

If you follow the instructions, a child who provided more than 50% of his/her support qualifies for REFUNDABLE AOC as long as he/she was over 18 years and 0 days by the end of tax year. ALL THREE have to match for the student not to claim the refundable part. I should add, provided he is not filing a joint return. Keep in mind that AOC follows the "exemption" (if you will).

-

Standard deduction is $12,000 for the student in question. You need to take out the second X on the attachment below:

-

Look for another post that we were discussing that VA was not ready to accept returns. Finally in February, the governor signed the law and made changes. Those changes affected all returns and for sure the ones with Schedule C. I am not sure if that's the situation you are experiencing but you should take a look.

-

Permanent resident since March 2018, no insurance yet

Pacun replied to Possi's topic in General Chat

I would select C for Jan, Feb and March. Then unaffordable for the rest of the year. -

I have a client who lived and worked the whole year in another country. TP is a US citizen and made $70K. Form 2555 asks for some information and on line 19 it asks for the income which is $70K. I don't find a way to have the income transferred from W-2 or other part of the form automatically. I have to override it and I have to override it in about 4 places to give me the exclusion. What am I missing?

-

How are they going to earn their living?

-

Wow I was hoping it was November 20th. I can barely imagine how to make it to April 16

-

Not your problema amigo. I don't even entertain any questions about this situation and I tell the client to send a check on April 10 or whenever they receive the bill, whichever is sooner.

-

Mine also does it when the clients owed.

-

DC seems to reject efiles because ATX is not doing calculation G1 which on Schedule DC-S on page 2. That calculation is for standard deduction, which is weird because DC is using Federal Standard Deduction and calculation is needed. I was able to efile a bunch of returns last wee and before, but all the sudden all of them are rejected except for a dependent who is filing using standard deduction to claim money withheld. Any DC users on this forum? If yes, please let me know if it has happened to you yesterday or today.

-

2018 IRA Distribution - Rolled Over within 60 Days 2019

Pacun replied to Yardley CPA's topic in General Chat

It seems right and remember that your client has to take mandatory distributions due to age. -

SaraEA is right...I will add that you need to have the children and the only ones that count are the one for whom you have paid child care and they are under 13 or permanently disabled.

-

We have a chat a work, and an employee is complaining that the employer withheld 0. She wants to talk to someone in HR, and any other department. I asked her when she started working for the company and she said Mar 3rd last year. I said "you had AT LEAST 18 chances to correct the situation when the pay check stubs were posted on line. Stop crying and pay the money". I am pretty sure HR cannot tell her that but they might be really happy I did... I MIGHT BE PROMOTED.

-

I used to blame the employer or the payroll software when I saw that a single person with "single 0" owed money. Every year was the same situation. About 8 years later, she left her job and at the end of the year she got a huge bonus. That bonus was paid around Dec 29th and they withheld a HUGE amount for federal AND it was paid on a W-2 for the following year. When I saw that W-2 I told her... "after 8 years of trying to get your employer withhold enough, they did it on this bonus". She reply, it was a bad calculation on my part, I always have 5 dependents on my W-4, but on December 15, I change to Single 0. I do that every year and I change it back on January 2nd, and I put back my 5 exemptions. I thought they were going to give the bonus in January but since I quit, they paid me in December and I didn't have time to change my w-4. Be cold and tell them, "you OWE and there is nothing we can do". If they walk away, let them walk. Remember having a W-2 that reads "single 0" means nothing. I don't read that anymore, I only read the numbers in box 1, 2, 17, etc.

-

Lion is correct. Let's say that they sold the house in April 20, 2018. Report the sale and the gain or the loss, if appropriate, in 2018 filing. Short sale doesn't necessarily means they lost money. Being solvent or insolvent on April 19, 2018 has no bearing on the future 1099-C. So let's say in May 17, 2020, the bank issues them a 1099-C for 64K, then you will have to see if they were insolvent on May 16, 2020.

-

It becomes a laughable matter when you see the contents of the letter but most people panic when they see an envelope from the IRS.

-

File at the same time. 1040X take about 4 months to process and need human touching from an IRS employee. The first return will be process by computers which are much faster and easily available.