-

Posts

4,620 -

Joined

-

Last visited

-

Days Won

26

Everything posted by Pacun

-

Correct me if I am wrong. We used to be able to call ATX and ask them to stop a return before it was "Transmitted to Agency". I have had a return for 18 as "Transmitted to EFC" for 18 hours and ATX said it cannot be stopped. They said that after we click "transmit" no one can stop it.

-

Just make sure that the person qualifies as a foster child and take the credit.

-

that's accurate so far. The change was only for 2021, but the night is still young.

- 1 reply

-

- 2

-

-

-

When people get a huge bill from the IRS, most likely they will not have money this year to pay the bill and pay estimated taxes. The issue is that people don't have money this year to pay the bill, so for sure they don't have money to send back to the 401k plan, which will be 3 times higher than the bill.

-

I think just the opposite. It is not obvious and it is an interesting question a only a handful of people know the answer.

-

Total income? MFS? Have you answer the questions where it asks you if the person is a felon?

-

I never figure it out but it has something to do with the receiving end. If it was ATX, it might have issues with every state which was not the case for me.

-

I got the same error from DC. I tried twice and then I waited a week and the issue was solved.

-

If you made improvements, you could also have additional depreciation.

-

Client received a letter from the IRS asking for proof of withholding.

Pacun replied to M7047's topic in General Chat

I guess the IRS has never sent refund for returns that are fraudulent and use fake W-2. Sorry for spreading that conspiracy theory. -

Depreciation uses 39 year. Direct expenses go 100% against the rental income received. Utilities are prorated based on the portion rented vs the portion used by the owners. Use the same ratio for taxes, house insurance, mortgage, etc. Don't forget to deduct from Schedule E a different portion of personal cell phone if used to receive calls or to check reservations from clients and your payment. I hope they don't cook for their clients because it could become ugly.

- 1 reply

-

- 1

-

-

Client received a letter from the IRS asking for proof of withholding.

Pacun replied to M7047's topic in General Chat

If I am not mistaken, the IRS gets everything together in December. They trust the W2s have the withholding claimed but the IRS doesn't have proof of that, hence they send fraudulent refunds with invented W2s. -

If reported only on line 1 of W2, take the credit. If reported on line 10, report it and the credit will be zero if that's the only child care expense incurred. I think I am right.

-

For clients that make a lot of money, this doesn't make any difference because the whole credit is used to kill tax liability. If you have daycare expenses, be careful and pay attention that it is refundable when your client makes little money. You must check that client or spouse lived in the US for more than .5 of 2021.

-

Let's say someone lives in El Salvador and he is a sole proprietor but has employees. He makes clothes using local materials and selling them locally. His payroll is prepared in El Salvador and at the end of the year, he reports his income in a form called Schedule C ElSalv. He lives in El Salvador with his US citizen child age 14. In 2020 his income was $60K and for 2021 was $300K. No tax treaty between the countries and he is Head of Household. Does he have to pay SE taxes? Will the child get only $2,000 Child tax credit. Will they both qualify for stimulus 1 and 2? Can they exclude income for both years but pay SE? Any information or suggestion will be appreciated.

-

I spent way too much time re-creating "expired" efiles.

Pacun replied to schirallicpa's topic in General Chat

The only problem I have experienced with your approach is that the State(s) return(s) are not checked. I usually create the efile files for both the IRS and the State, when I read the errors or suggestions, I make the corrections and save the return. That eliminates the efile file and marks it red. If no errors are found, I go and delete the date you are talking about and save it. -

I would bring to the conversation only if that changed anything. That's the point. It is irrelevant, unless the original poster thought it was relevant, hence my comment.

-

Since the EIP3 or any EIP's money doesn't need to be returned, why is that mentioned here? Follow the regular rules and amend if necessary.

-

I admire your clients. My clients don't make that suggestion.

-

I spent way too much time re-creating "expired" efiles.

Pacun replied to schirallicpa's topic in General Chat

Efile gives you suggestions and rejections when you create that are very useful. For example, when I create a new MD client everything seems to be OK. Federal is OK, state looks good, and a lot of times I have told the client, MD will refund you this much, just to find out that the program doesn't pick up the county tax which makes a huge difference and a lot of times turns a refund to a balance due. Another one that I have noticed is the penalty for early 401k/IRA withdrawal. Sometimes the program doesn't open the form soon enough. As someone said, put your tools to work for you and my computer is my main tool. I came back to state this: You don't need authorization to create efile files, you need authorization to transmit the return to the efile system(s). Let's go back to the time when paper was standard. When did the client authorize you to send by mail the 1040? When he signed it, correct? Following your advice, the first thing you would tell the client would be: "please sign this blank 1040 form so I can start working on it". Wouldn't make any sense, would it? -

Please ATX - please rollover driver's license numbers

Pacun replied to schirallicpa's topic in General Chat

The idea is that we need to ID every filer each year according to the IRS. I don't think ATX will roll over license info in the near future. -

It's complicated (some peoples relationship with taxes)

Pacun replied to ILLMAS's topic in General Chat

File 2021 at once and request an ITIN for wife. Attach a letter signed by both stating they want to treat spouse as a resident for tax purposes and that they are reporting world-wide income. It doesn't matter when the taxes are filed in the foreign country since you file a calendar year not a fiscal year in the USA. With the pandemic schedule, it will take a couple of years for the spouse to get a social security number and that's what the ITINs are for. Remember that filing for 2020 will give him stimulus 1 and 2. So, I would file since it is not my fault that money was given away like crazy in 2020 and 2021. -

I thought where is my refund ONLY checks current year.

-

I thought most preparers hated home office due to the fact that we know that very few people comply with the exclusive use requirement, but I guess I am wrong. This is my idea: I will suggest my clients to make a tiny room big enough to have a chair and 12 inches for leg room (Maybe 40X30 inches). have a chair over there and have the driver go every day, sit at that chair, with cell phone on hand check where the uber heavy business volume is for the day, check if your payment hit your bank, etc. That will cover the exclusive and regular use. Again, it seems that Uber is now counting every mile as soon as the driver opens the application and connects to the uber platform.

-

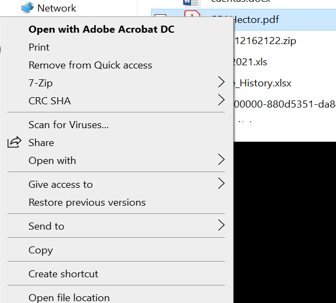

Place a pdf file on your desktop, make sure it is not a shortcut and then right click it, properties and select Acrobat reader. My picture was cut, the very last choice should be "properties". I am almost sure that edge is the program selected as the default program to open pdf files on your computer and that's why you are having issues. You could also select acrobat reader for .pdf files but that's more elaborate.