-

Posts

7,106 -

Joined

-

Days Won

396

Everything posted by jklcpa

-

IRS Examiner's Guide on Changes in Accounting Method should have your answers: https://www.irs.gov/irm/part4/irm_04-011-006#idm140266566991872 Also, from that guide:

-

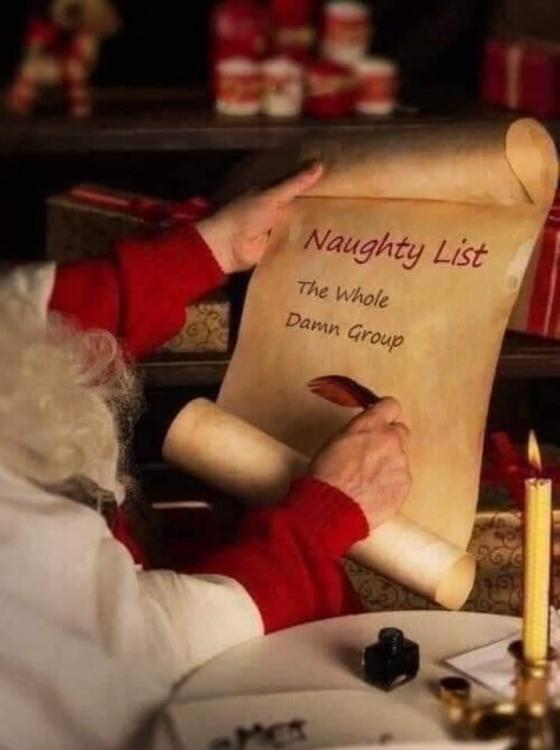

I couldn't resist sharing this one here. Again, Merry Christmas to everyone, and thank you to every one of you for making this a great place.

-

Welcome to the group, Sandy! It isn't an export function from Drake. You would use the ATX conversion: https://taxna.wolterskluwer.com/conversions Since this is actually a question about using the ATX software and a process within its program, I'm moving this topic to General Chat since most readers probably don't look at our Drake subforum. I'm currently a Drake user that moved from ATX, but I'm sure we have some members that also have moved back to ATX from other vendors that may be able to provide more specific answers if you run into trouble. Of course, you'll have to check the newly converted ATX returns for accuracy, but matter what two software programs are involved, I think the main trouble spots in any conversion are in the areas of fixed assets/depreciation and any existing unused loss-type or credit carryovers.

-

To be clear, David is asking about the ownership questions on the 1120's Sch K, questions 4a and 4b shown below for the stock that was purchased by the 401(k) plan:

-

The answers you seek are in the third post above, although don't expect any additional dialog from the participants as most of them have stopped participating on this forum. Also, thanks for reviving a 12 year old topic. You should know that we don't help the general public on here, and rather than trying to work through a case involving an irrevocable trust, you should consider consulting with or hiring a professional that is competent in the area of trusts.

-

Read the plan document. It must specify the definition of "compensation" for each of the specific purposes of employee contribution, the match, and for nondiscrimination testing.

-

NOLs must be carried back first unless the taxpayer elects to waive the carryback, and that election is made on the original, timely filed return including extension. At this point, your client can NOT make this election and must carry back first before attempting to carry anything forward. Would there be any loss remaining after carrying back?

-

For those that don't click the links:

-

The link I provided includes that procedure in detail and all of the required information to request the first time penalty abatement, either in writing or by telephone. There is also information about when, why, and how to follow up or document the conversation if handling by phone. Since many don't click links, I've provided all of the information in the next post.

-

https://www.aicpa.org/interestareas/tax/resources/irsprocedureadministration/irspenaltyabatement.html Be sure to scroll past the ads to the bottom.

-

As Gail suggested, prior experience and/or skills, and the skills the job requires would all factor in. One method you could use to see if your hourly rate is within reason: start with the amount you would be willing to pay on an annual salary basis (based on expertise, skill set, or the cap for the position) and divide by annual working hours to arrive at an hourly rate, and compare to other jobs considering your local economy. Adjust from there.

-

An error, for sure. Currently on the site:

-

Really? It's paid by the taxpayer, either by paying directly to the government for those not receiving SS benefits or by choice, or it is withheld from benefits. Either way, the taxpayer is paying premiums out of otherwise available resources. It hasn't been an issue in years and won't be challenged. IRS Chief Counsel issued its legal interpretation for use by IRS personnel back in 2012 that addressed this and stated that Medicare coverage for the self-employed person AND spouse are eligible. Chief Counsel Advice (CCA) 201228037 http://www.irs.gov/pub/irs-wd/1228037.pdf JoA article from 2012 in explanation. https://www.journalofaccountancy.com/news/2012/jul/20126051.html Also, it's now clearly addressed in the Form 1040 instructions for line 29 that this IS eligible for inclusion in the calculation of SEHI. IRS statement on use of CCAs from IRS website: If by second policy you mean that a TP has 2 (non-medicare, non-medigap) health policies, then there are specific rules and 2 separate worksheets need to be completed for the SEHI. If, by the above statement that you are referring to MediGAP as secondary coverage to Medicare, that is eligible for inclusion in the SEHI calculation, as are other policies for dental, vision, drugs, and long-term care.

-

MeF shutdown for business returns will be Dec 26th. Top post has be edited.

-

Ack! Dan, you are correct. Second time this week with bad code! I surrender. @FDNY, I'm sorry. I deserve no turkey, and certainly no dessert for me!

-

@FDNY, I found cites for you: Sec 35 is the section that covers SEHI, ,and subsection (e) has the list of qualified coverage. The first item listed as allowable for SEHI under Sec35(e)(1)(A) is "Coverage under a COBRA continuation provision (as defined in section 9832(d)(1)). Then, Sec 35(f) "Other Specified Coverage" section talks defines "subsidized coverage". You can read that section, but basically says that subsidized is where at least 50% or more of the cost of coverage is paid or incurred by the employer. Here is a safe link to Cornell Law of that section if you want to print or save the documentation: https://www.law.cornell.edu/uscode/text/26/35

-

I don't have an answer but will give you two conflicting points of view. Sorry it may not be much help except to say that there isn't clear guidance, and that is the reason you aren't finding a definitive answer. There are two issues: first, is it continuation and participation in a group plan established in the name of the former employer, and second, is it subsidized. I could certainly be wrong, but I believe COBRA coverage is a continuation of coverage that is considered to be group coverage under the plan established in the name of the former employer. That's going to prelude taking the SEHI deduction for COBRA premiums because it isn't established in the name of the individual or S.E. business. Take a look at the COBRA information found on the DOL site here: https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/faqs/cobra-continuation-health-coverage-consumer.pdf One of the reasons I say it is still continuation of a group plan of the former employer is that the COBRA coverage can end if the former employer ceases to exist, chooses to discontinue offering coverage and terminates the plan, or if the # of employees drops below threshold and employer is no longer required to offer COBRA coverage. Also, in the past I've seen the invoices received by corporate clients with former employees that chose COBRA coverage, and I recall seeing the former employees' names on those invoices but with no premium charge because those were being paid by the employees separate from the company. Also, keep in mind that the employer could choose to pay some or all of COBRA premiums as part of their overall benefit package, and I don't think that would be allowed if the former employees' COBRA premiums were considered a separate individual plan. Again, just my unresearched opinion. _____________________________ With all of ^^ that being said, Lasser says that it's an unclear position. Here's a Q & A from last year that also isn't much help except to say that there's no official guidance on whether or not the COBRA premiums are still considered an employer subsidized plan. Here's the C&P from Lasser's site:

-

^^ I apologize about the wrong answer I gave you regarding separation from service and age 55. The part of your statement shown above is correct, and clarification of this part of the code was provided for in Notice 87-13. With that in mind, I do believe that this exception would only apply to distributions from the plan of the current employer that the participant is separating from. In other words, if that person has another plan from an earlier former employer, a distribution from that earlier plan in the year of attaining 55 wouldn't avoid the penalty because it isn't related to separation from that employer specifically. I hope that makes sense. Concerning your second question about whether the above rationale could be similarly applied to distributions to the participant before attaining age 59 1/2, my earlier answer is correct as it stands. The participant must reach age 59 1/2 before the distribution to avoid the penalty.

-

Entirely different scenario and still subject to the penalty. This exception to the penalty relating to separation from service is in the same IRC sec, this one falls under 72(t)(2)(A)(v) that says "made to an employee after separation from service after attainment of age 55". Did you look at the page I linked to and scroll down to subsection (t)?

-

The first exception to the penalty listed in Sec 72(t)(2)(A(i) says "made on or after the date on which the employee attains age 59½." Note that there's no mention of "by year end."

-

I suspect that Abe may not be in our business and should hire a professional. Also, not in CA.

-

It is the sum of the monthly contributions (1/12 for each eligible month) but as long as the taxpayer is age 55 by the end of the year, then the person will be allowed the full catch up if the taxpayer is in a HDHP for each of 12 months, even for the months before he or she actually turned 55. In other words, for 2020 someone with single coverage and 55 or over by year end, the allowed monthly contribution is $379.16 (1/12 of ($3,550 + 1000)). For 2020 with family coverage and over 55 by year end, the monthly amount is $675 (1/12 of ($7,100 + $1,000)) for each month of eligibility. In both of your examples the TP is eligible for all 12 months, has family HDHP, and is 55 by year, so the contribution allowed will be the same = $8,100.

- 1 reply

-

- 2

-