-

Posts

7,105 -

Joined

-

Days Won

396

Everything posted by jklcpa

-

So this is why @RitaB hugs 'em first.

- 4 replies

-

- 14

-

-

-

Were you able to resolve this with the agent so that the return will now be processed? Were there items of income or deduction on the return that would have been filed with IRS on paper 1099s. Remember, only paper-filed documents were shredded, not anything electronic. Does the return have items that the IRS may be waiting to verify with outside sources that may not have been filed yet such as IRA or HSA contribution made before 4/15/22 for 2021 that would be on a form 5498, or something like excessive federal withholding on a W-2 that would be filed with SSA? Maybe something else that is not within an acceptable parameter to the IRS? We're all just guessing at this point, and I'm concerned that the agent couldn't tell you why this return was held up.

-

Maybe a stupid question, but is that the IP PIN for the 2021 tax year, or for 2020? Client could try to retrieve her 2021 IP PIN from the IRS tool to verify it and to make sure it is the one for the year you are trying to file.

-

Not enough information to answer you. What was the reason IRS denied the claim? Was it something about the loss itself or its calculation, some calculation made with the claim to the carryback year, or you didn't supply all information with the c/b return? Did you include AMT calculations? You have to include that even if it is fairly obvious that AMT doesn't/can't apply, and if you don't, IRS will not process it. Depending on answers to those questions, I suspect you will end up correcting something with the carryback to 2015 to move forward with processing.

-

Why is e-filing the 941s so complex and separate? That form certainly isn't complicated compared to the 1040 series, the 1065s, or 1120 series. Why can't a version of it be included in MeF?

-

The scanning technology that IRS uses for paper-filed 1099s is very old though and that is why the service requires those be prepared on forms printed in red dropout ink.

-

No, I do that too and did not take offense so there is no need to apologize. It just bugs me when I make stupid mistakes in haste.

-

Yes, well, that is the thing because I do know something about this and made another stupid mistake on here by shortcutting my calculation by not separating out the catchup.

-

Yes, I agree with those final figures. To be totally clear and expand on your statement about each being able to contribute the $1,000 catchup, the husband's additional contribution will be limited to 5/12th for those months prior him going on Medicare. Husband's form 8889 will show $1,520.83 ($3,650 x 5/12) on line 3 and $416.67 ($1,000 x 5/12) on line 7. @BulldogTom Tom, sorry I was wrong and guess I should stop trying to help anyone at this point.

-

Yes, this is the figure I get too. For the overall limitation, changing the allocation within the first 5 months won't affect the final annual limitation but will determine which HSA can receive the funds. That may or may not matter to your clients.

-

The difference between family and self-only is the number of persons covered, so if/when the wife drops coverage for the husband, the policy will become self-only unless there is someone else still on the policy so that it covers more than one person. They currently have family coverage and can avail themselves of the monthly family HSA contribution rate during those months, but once he is dropped from that ACA policy, at that point the wife's policy will become self-only for purposes of the monthly HSA contribution rate starting with the month he stops being covered by the ACA policy and goes on Medicare Part B. With that month and going forward, he becomes an ineligible person for the HSA contribution and his monthly contribution limit is -0-, and wife's monthly maximum contribution will be for the self-only amount.

-

Form 8962 is used to either claim the PTC on the return being filed or reconcile the PTC with the APTC used during the year. If either of those pertains to your client, you need to include the form, otherwise it sounds like you can probably delete it and ignore the 1095-A. To be sure though, you should review the instructions for Form 8962 under the section "Who Must File"

-

That's great. Hope they fixed the prior years too.

-

That is true, and if/when he does sign up late, there is a special form to tell the government why he didn't sign up at age 65 so that he isn't permanently charged a higher (penalty) rate.

-

You have to fill out the contribution limitation for each person separately, then add the monthly amounts together. Because H wasn't covered by the HDHP for the entire year and went on Medicare during the year, fill in -0- for the month he started on Medicare and subsequent following months. From your fact pattern, it should work out that wife will be entitled to contribute for her half for the entire year and husband's half will be prorated for the number of months covered under the plan. The instructions for Form 8889 may be more clear.

-

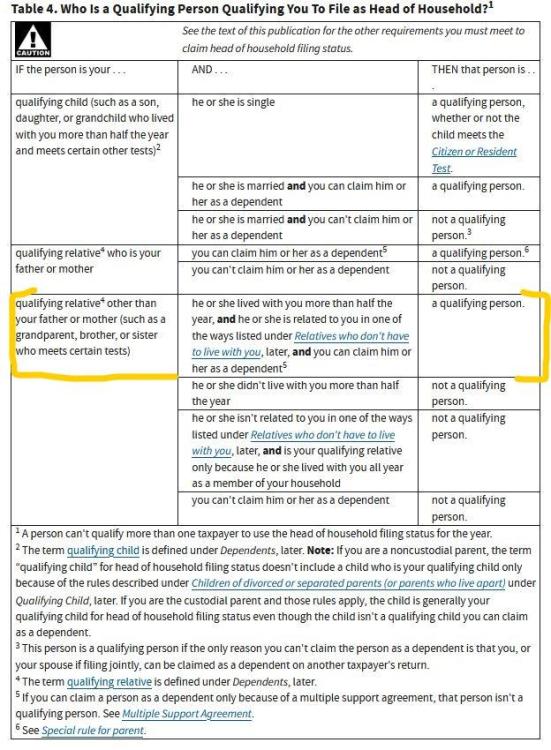

If adult child isn't a qualifying child but does meet all the tests to be a qualifying relative that the taxpayer can claim as a dependent, is related to TP, and who lives with the TP more than 1/2 of the tax year, then that QR would be a qualifying person that would allow the TP to use HOH. See this snip of Table 4 from Pub 501 below:

-

Does this mean the entire desktop versions are going away for those of us that use it for write up work, or is it only the payroll functions and reporting?

-

Thank you, Margaret, FDNY, and Catherine.

-

From an article posted by The Tax Advisor, posted in entirety for those that don't click links:

-

Thank you for the birthday and well-wishes. Birthday was low-key, relaxed at home, and made some delicious strawberry shortcake. I'm pretty much recovered and feeling back to my old self again already. I'm certainly not overworked because of my workload as I am probably one of the few here that is definitely underutilized. I've purposely not taken on any new clients in the last 3 years and a few of my business clients have either sold or retired, so that is also less work during tax season and the rest of the year too. I did take one new referral in early April but that is the first in a while for me. The reason I end up working into the wee hours is because I now spend a total of 2-2.5 hours a day on mom's lunch, dinner, and bedtime routine each day and doctor's appts, etc., and then there is my husband's health issues. Read on if you'd like to know more. There are only a handful here that are aware of husband's health issues, but for the rest that aren't, he is battling TCC bladder cancer that was discovered in early 2019 during the pretesting leading up to treatment for prostate cancer (PSA well below 1.0 now). At that same time those tests also revealed that his heart was skipping 30K beats a day (1/3 of normal beats were missing or erratic), and he also had an abdominal aortic aneurysm. The moral of his story is if a doctor tells you that you have cancer and can "wait, watch it and see...," please consider a second opinion or think long and hard on that choice! If he'd listened to those first 2 doctors about the prostate cancer, then his heart, aneurysm, and TCC may have been discovered too late to treat, as is often the case. So in a little over the last year or so he's had corrective surgeries for the heart and aneurysms plus the ongoing bladder treatments, biopsies, and followups for that. He's doing really well overall but had a major reaction to the BCG bladder treatment on 3/16/22 and ended up in the ER that night and hospitalized for 4 days with a major fever, the cause of which has yet to be determined. The ER visit and subsequent admittance cost me an entire night's sleep being there with him and where I then went from there straight to 3 client appointments, and just the extra time spent each day with him in a hospital that was 1.5 hrs away round trip in the days that followed. All of that left me that much shorter of time that I have had to devote to tax preparation this year, but I got it done with only 2 clients on extension; 4 in total but one of those individuals also has 2 small partnerships along with the individual return. So, worry not, I'm feeling better now and have mostly caught up on my sleep. And for those that would say I was here too much in light of all of that, helping others here is actually a break from my own reality at times. If you made it this far and read all of this, thanks also for listening!

- 20 replies

-

- 10

-

-

Glad the perps did not gain entry.

-

How are you all feeling, and are you feeling mostly recovered? Besides sleeping more and going back to normal hours, what are you all doing to recover and what are your plans for enjoying your personal time? I didn't realize just how very tired I was and still am. Husband and I went to an evening concert this past week, a very loud concert, and I was actually falling asleep after the intermission. Thank goodness we stopped for coffee and he was the one driving home because he's usually the one that's napping along the way. This morning I also realized that along with the extreme weariness, I've been having a slight issue at the prospect of turning 62 this weekend and feeling old, that age when some start collecting social security, and that feeling is totally out of character for me. I remember having these same feelings at reaching the age of 50 and mentioning it to many of my friends, and here I am telling this here too! I may need to go for a bike ride, a walk, or some other fun thing. Most of my enjoyment involves outdoor activities, and maybe I'll get in some fishing this year too before the temps and humidity here feel like an inferno.

-

Thanks again for being correct. I just updated my android phone that is my latest device of ~ 1 yr old, and it is at the version 100.0.4896.127 after the update yet the Win 10 desktop is now most current, which is a very good thing since it needs and has the most protection.

-

Oops, the most current version I now have is the most recent at version 101.0.4951.41 after I relaunched. Thank you, Lee, for confirming. Next up is to check my androids.

-

I don't use Chrome all that often and have manually updated today to this version 100.0.4896.127 (Official Build) (64-bit). Can someone confirm that this is the updated version we should have after this latest discovery, or is this the version that has the flaws that allowed these hacks and the latest patches haven't come out yet?