-

Posts

7,104 -

Joined

-

Days Won

396

Everything posted by jklcpa

-

A couple of years ago I agreed to prep a very simple return for an employee of a business client. Prior CPA preparer charged btwn $450-$500 for a return with one W-2, two SSAs, one 1099int, one 1099R, standard deduction...AND IT HAD ERRORS. HRB would have been even higher around here! Former preparer wouldn't return their calls, and they took it there in person and former preparer refused to acknowledge the error or fix it. These people are really, really nice too. They were really nervous coming to pick up the returns and the amended ones from me, naturally being worried again about the CPA price. I was nowhere near that fee!

-

Well I am too and most of my clients aren't anywhere near in this range. I am serioisly curious though what some others of you would charge for a return package that included nine returns that included splitting the income and deductions manually for those states to be correct, had 2 complicated projections containing 3 scenarios and done at different times during the year, had to create the mortgage amortization schedules and tie in the balances for one that settled midway through the year, another starting during the year, so 3 mortgages altogether and about 2 million in debt. I spent at least half a day on all that not including the phone calls or the meeting with them at the end to deliver and explain it all, the handholding and questions afterward, and finalizing the efiling. How much would you charge for more than a 1/2 day of work in total?

-

Tom, does ATX allow attachment of a pdf? I can scan and attach any statement I want. I just have to fill in three things: a basic explanation or form it relates to, a reference (such as the form, pub, code, reg, memorandum) and the name of the file with a .pdf extension.

-

There are lovely people I serve too though. I delivered a return yesterday to a client/friend of almost 40 years. She's 95 now in assisted living. Return isn't *that* complicated but has half a dozen 1099Rs, one consol broker 1099 package with only 40 page or so, the bigger main consol broker 1099 package that was only 60 pages, and a PTP. We had a really nice visit and did some reminiscing. People like her remind me why I still do this work.

-

I would be in the $400-500 range too, depending on how much work I had to do on the rental and basis of stock. If the basis is printed on the broker 1099, that is less work than if the client brings in basis from an inheritance or older purchases where they've changed investment firms, etc. I had one that I started to list in the complaint topic and changed my mind. The guy did not return to me this year because I charged him $800 last year. He'd been a client for more than 10 years and I cut him big breaks on the calls and projections, but not on the returns themselves, and I still undercharged him. He also owed about $60K on the federal alone because he has huge bonuses and never calls, and does stupid things like using retirement distribs to purch the beach property, and underwithholds or has no withholding on that income. Tax prep and other work included were for: high income earner W-2, so also had Medicare add-on tax, but not even $1 of interest or dividends so no NIIT, Sch A with SALT and mortgage limitations, sold 2nd residence which also had extended calls to fill out the form to avoid the state tax withholding at settlement, purchased another beach house, this one as rental but with lots of personal use, and didn't agree with explanation of expense limitations and argued that, 3 retirement distributions with partial rollovers and minimum withholding of 20% in the 39% bracket. These partially used for new beach house/rental, a complicated projection with 3 scenarios for a possible early retirement. Sent me a 200+ page booklet of explanations of these deals that he then demanded answers for within a day (the week I had the flu too!), multi-state as DE resident and working in PA, out of state credit and a daughter's return that was PY DE, PY NJ, and worked in Phila while living in each of those states, and then worked in NY city once fully moved to NJ. So with all of that, it was parent's Fed, DE, nonres PA, 2 complicated projections, and daughter's Fed, part-year DE, part-year NJ, nonres PA, and nonres NY and NYC returns. Nine returns in total. His other adult daughter left too. Charged her ~ $500. Similar BS with multi-state: She works in PA, husband in DE, they sold home in DE and moved to PA during year, has 2 children for the CTC and dep care credits with the documentation and due diligence, unemployment, std deduction for federal but each itemizing for DE on a separate basis, plus they live in a PA jurisdiction that has local earned income tax. So that one was joint Fed, 2 separate PA, 2 separate DE, 2 separate locals and figuring the out of state credits on those was a PITA. Not a word from either of them to know why they were unhappy. Those are the type I typically never take back because they were unhappy enough to leave and not give any courtesy to me after more than 10 years as clients and lots of free advice. I hope they are happy with their new preparer and higher fees, and if they contact me in future I will joyfully and firmly say "NO THANKS."

-

Yes, a horrible season. Getting the information from people seems to get more difficult each year, and no one likes the price increases when all I've done is raise the price to just stay even with my increased costs. Increased aggravation to make less than before? No thanks.

-

8582 must be produced to determine the correct amount of net loss to use at the bottom for the limitation, if that actually applies. What boxes are checked on the input for the activity? What is the modified AGI being used? Have you checked to make sure that MAGI is below $150K, and that you aren't basing your statements on AGI? I doubt Drake is wrong and is probably doing what you are telling it to do based on your input.

-

Tom, I have not done one myself but took a look at the instructions. I think it goes in section B for losses from business and income producing properties. Then, take a look at instructions for line 19 where it says to include all of the details you have for it if claiming a loss from fraudulent investment schemes that are not Ponzi-type and are not filling out section C. See what you think of that after looking at those instructions. That's the best I could make of it.

-

You will need to file the WV return and report the sale of thr property and show the amount of tax withheld as a payment. I haven't looked at WV instructions but it is customary to include a copy of the form showing the tax withheld. Then, MD will also tax the sale of property because your client is a MD resident. MD allows credit for taxes paid to WV on everything except wages, just as Lion said. Use form 502CR.

-

NT: are we this weird, or this amazing? or both!

jklcpa replied to Catherine's topic in General Chat

Yes to both weird and amazing. -

He would have to sign if that local return is on a joint basis. I don't know which jurisdiction, but those are usually for earned income. If that is the case and he has no PA earned income, they could file the local EIT returns separately, each signing their own. She would file her own and sign it. If he has no earned income and has permanently moved out of PA, he should file his marked "final". The generic local return has a place to give a reason for not having to file that in future, such as "retirement" or moved out of jurisdiction. If you have the preprinted form from the local tax authority, the one printed in red drop-out ink, there should be account #s above each column that belongs to each of them individually.

-

I agree with you. In the cases where not required, the returns are filed without those schedules, but I do prepare and print the Schs L, M-1, and M-2 for my file. That time is minimal, and excluding from the efile is a matter of unchecked a box.

-

None of the examples in the original post would need to include Schs L, M-1, or M-2. Your friend is correct. Both components must be over $250K to require the schedules. The test is NOT with them added together.

-

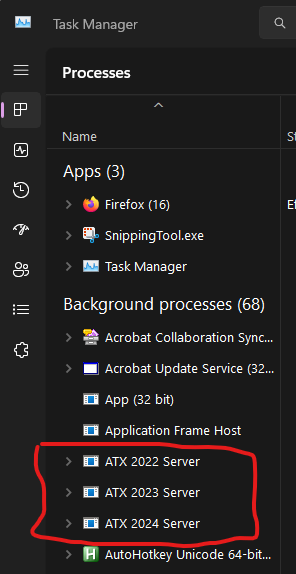

These are posts from Abby Normal as posted in another topic. First post: "Not having a full and complete backup of all of your files is foolish. In addition to backing up the entire Wolters Kluwer folder, you should at least backup your documents and many other things in your Users folder, plus anywhere else you keep important files. It's important that you end the ATX servers, all of them that are running, before backup up the Wolters Kluwer folder. Occasionally, I turn off all the ATX servers and copy the entire Wolters Kluwer folder to My Documents and then it gets backed up with all my other documents. I name the folder Wolters Kluwer yy-mm-dd and keep the latest 3." Second post - to turn off ATX Servers: Bring up Windows Task Manager and end the ATX Servers tasks. You end them by right clicking on them and choosing End task, or by selecting them and pressing the Delete key (DEL). Knowing how to end or restart tasks is an essential ATX skill. To start Task Manager, you can use the menu and type 'task' or right click the taskbar and choose Task Manger or my preferred method, Ctrl+Shift+Esc.

-

- 3

-

-

For future use for everyone using ATX, I'm going to copy Abby Normal's instructions to a new post of how to backup ATX data outside of the program and pin it at the top of general chat.

-

I didn't know this. IRS IP PIN replaces two old ones

jklcpa replied to Pacun's topic in General Chat

You mean the IP PIN, and yes, the most current one issued is the one to use for the current year being filed and the 2 prior years. -

I had my sister in law's birthday off by one day and by one year too! For almost 50 years I thought she and my brother were born the same year but is actually a year younger. Their return has never rejected since e-filing began.

-

I really didn't have to enter much data. On the main screen where 1095A input goes, I entered the spouse's name and information because she was the only one covered by a marketplace plan and I entered all of the figures for the entire year. Then I went to another input area and entered as below. Note that system asked for taxpayer's data and months only if enrolled in a marketplace plan, so I didn't enter anything there. Drake automatically calculates anything with an "=" sign and any entries in those boxes would be considered overrides, so that is why lines 11-23 are blank.

-

What program are you using? Are you overriding entries to try to force the figures to what you expect? I try to not override unless absolutely necessary. I entered in a practice return in Drake, so the names and SSNs are fake. Here's what it produced based on your information using the alternative calc for year of marriage. Pdf is 5 pages : 8962 & worksheets.pdf

-

Yes, you are correct that it should be "2". I read again about the separate family size for each that then gets added together for the 8962 line 1 entry.

-

Is the high ded plan for individual or family coverage? Which box is checked on the 8889?

-

I take back what I said earlier about MFJ should have a "2" on line 1 of the 8962. Line 1 of the 8962 should have a "1" in it for the spouse-only's tax family size that is being used for the alternative calculation. I think this may be causing your e-file error. Note - I have not reviewed any dollar amount entried that you may be discussing with others here. Here is a snip from pub 974 about tax family size when using the alternative calculation: Alternative Family Size Alternative family size is used to determine an alternative monthly contribution amount (see Monthly contribution amount under Terms You May Need To Know, earlier) on worksheets I and III, which may reduce the amount of excess APTC for the pre-marriage months that you must repay. When determining your alternative family size, include yourself and any individual in the tax family who qualifies as your dependent for the year under the rules explained in the Instructions for Form 1040 or the Instructions for Form 1040-NR. Do not include any individual who does not qualify as your dependent under those rules or who is included in your spouse’s alternative family size. When determining your spouse’s alternative family size, include your spouse and any individual in the tax family who qualifies as your spouse’s dependent for the year under the rules explained in the Instructions for Form 1040 or the Instructions for Form 1040-NR. Do not include any individual who does not qualify as your spouse’s dependent under those rules or who is included in your alternative family size. Note. You may include an individual who qualifies as the dependent of both you and your spouse in either alternative family size.

-

No, not the heir, but if you are preparing the final tax return for George & Elizabeth, they may be able to finally use some of the suspended losses. The property is considered disposed of on their final personal income tax return. Below is the paragraph that explains how it would work, and that is taken from this article by The Tax Advisor: https://www.thetaxadviser.com/issues/2017/jan/carryovers-death-spouse/

-

Do you have a "1" on line 1 for the size of the tax family? If married, that should say "2".