-

Posts

7,104 -

Joined

-

Days Won

396

Everything posted by jklcpa

-

The incomparable thrill of meeting the deadline. Almost 2 a.m. and 4 coffee cups, that would have been about right in many past years for me.

-

I'm done and done in. Last night I dug a hole on the edge of my foot to remove an already inflamed deepish splinter and went off this morning to the 5K charity event with a bunion pad and bandage. I completed only half of that, and then the sporting clays went about the same, like I was a raw beginner again. I had an awful season this year. My Mom passed at the end of Feb, and the I got the flu-a in early to mid March and missed many days. I actually sent 3 returns and a trust away because of it. There were a few days that I don't even remember in March when I started back working and was still very sick. Glad this season is over. If you made it this far, thanks for listening to me whining.

- 32 replies

-

- 14

-

-

-

-

Yes, absolutely we want you to stay with us.

-

Have you included the nonresident/part-year ratio schedule in the return? That ratio from the schedule would be applied to the overall MT tax on all income so that the tax is reduced to the same ratio that the MT income represents of the total income.

-

Certain people do come to mind and then they turn to dust. Breaking things after an aggravating day can be very satisfying.

- 32 replies

-

- 10

-

-

-

There is a fillable version available from irs.gov here: https://www.irs.gov/pub/irs-pdf/f8978.pdf and the instructions: https://www.irs.gov/instructions/i8978 Good luck!

-

I have no experience with this and don't use ATX but googled and found that ATX does not list this form as part of the ATX packages. https://support.atxinc.com/taxna/software-system-requirements/atx-forms

-

I'm done. This morning I filed the extension for my ultimate procratinator, and other than the extended returns, I am waiting on one to pickup (SO unexpectedly hospitalized day she was scheduled to see me) and one couple that have had the returns for almost a week and must return the 8879 to me. Tomorow I am participating in a charity event in the early morning and then will be shooting at the clay pigeons. That's been ongoing as weather permitted and really helped keep my sanity this year. Plus, it's fun.

-

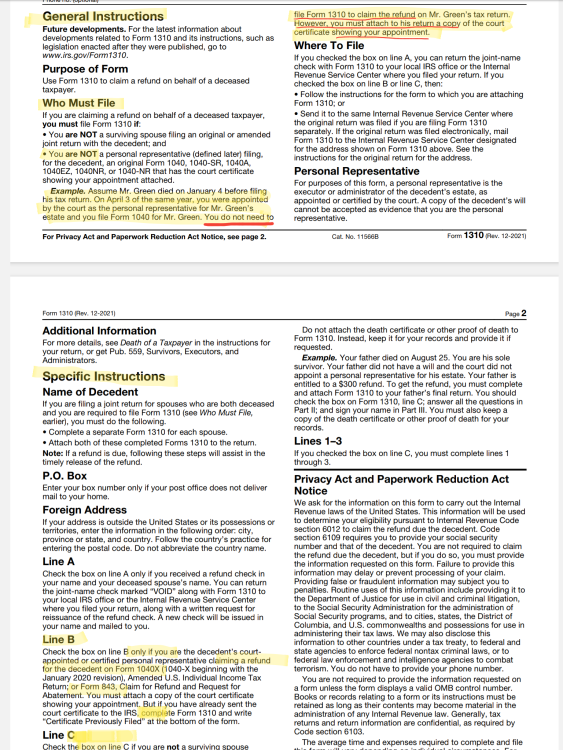

TexTaxToo's quote is directly from the 1310's instructions. I don't know why this is so hard either. If Yardley's client (the son) has a Short Certificate, which if in his state would be the only official legal appointment LIKE IS HERE IN DE, then the form 1310 is NOT REQUIRED.

-

Yes, this is correct. It depends on how long the investment has been held.

-

That's what I do too, but it is so frustrating. This is a large return in terms of the number of bank, brokerage, and retirement accounts and pensions this couple has.

-

"Court appointed" is why I said to attach a pdf of the Short Certificate that the son has already obtained. Here, the Register of Wills is THE agency with the authority and issues the Short Certificate because our county Register of Wills is a branch of the Court of Chancery and definitely has the legal authority to issue that document showing the official legal appointment of the named executor to act on behalf of the estate. Maybe it works differently where you live, but an executor here with a Short Certificate in hand has all he or she needs and could definitely file without the 1310.

-

It's more likely that this is some sort of stipend that isn't taxable as federal wages but had the SS & Medicare withheld. As others said, either ignore the w-2 completely or enter $1 as federal taxable wages. Personally I'd ignore it if there isn't anything in any other boxes that needs reporting. Nothing on the that W-2 that affects any state return?

-

In general, for any filer whose SSN is used on the return and has an IP PIN, that IP PIN must be entered on the return or the return will be rejected. Even a paper-filed return will require the entry, or without it the IRS will need to verify the identity through other methods and will slow down its processing. Is it possible that the spouse opted to retrieve the IP PIN electronically and a paper notice wasn't mailed? This sounds like a case where a call to the IRS # for special situations is needed to answer the question.

-

No. It is different for a corporation and not at all the same as how a partner handles UPE. Corporation would need to set up an accountable plan and reimburse the shareholder. An example of where this is used is personal auto used for business purpose, shareholder keeps mileage log and submits a report to the corp for reimbursement. Corp reimburses at the allowed federal rate. There are other accountable plans that have more specific tax law rules such as medical reimbursement plans or when to reimburse shareholder paid disability insurance premiums. If there is carelessness or intentional comingling of expenses paid from the corp accounts, you may want to have a discussion with your client about not using the corp's checkbook as his/her own.

-

My client is sharp too, just the ultimate procrastinator. His type of treatments won't cause any brain fog, but just one more thing in his day that's taking up time. I know about the cancer issues with my husband having had 3 types, 4 if we count minor skin cancer too. Throat, prostate, and TCC aggressive bladder cancer.

-

You don't need form 1310. You can definitely request an extension by e-file. You should also be able to scan and attach the short certificate to the return itself and e-file that too. See below. For purposes of form 1310, executor is considered the "personal representative," so this return doesn't need the 1310. See below. Be sure to enter the name of the executor in the "c/o" name box in your input and change the address to that of the executor. This is what will be on the 1040. If you look at the instructions for "Who Must File" you don't need the form 1310 because son IS the personal representative of the estate, and for purpose of this form, the executor is considered the "personal representative". You should be able to scan the short certificate and attach that as a pdf for the return and e-file it. Please see the example as shown in the instructions to the 1310 below:

-

For me, this site is a place to learn, get answers, vent or commiserate, or just take a break during the day. It continues to be an invaluable resource that's been a part of my daily routine for 17 years. Eric has taken care of us from the site's inception, mostly unseen, and his work is ongoing. Soon he will migrate the forum to a new host and is waiting for us to get through the 15th before doing so. I've made a donation today and hope others here will consider that as well.

- 2 replies

-

- 10

-

-

-

^ This, or if client changes bank accounts.

-

There is also EFTPS that allows scheduling the current and/or future payments at one time. It does give the ability to cancel or change those not yet paid, but the limitations are that it must be linked to one bank account and does not have the other functions that having an IRS account has.

-

What am I going to do with this guy?! It's every year and getting worse. It's not like April 15th isn't a new date to anyone. The other day I was in the area of his business and managed to pick up his and wife's W-2s from a manager of his business that happened to have copies of the forms. That's another story. He thinks he may have given all his tax documents to his new loan officer at the bank who was going to help him prepare his personal financial statement that the bank requires to renew his business line of credit. He mistakenly thought he'd given me documents. I've asked and reminded him multiple times that I have not received anything from him for 2023 tax year. Today on the phone I had to repeat 3 times that I needed all documents with withholding on them (two 1099-SSAs and 1099Rs for their numerous IRA distributions and wife's pension). He also has a few investment accounts too. He is 80 and a long-time client. I know he's overworked and also in the early stages of cancer treatment, but seriously, what can I do? What would you do?

-

Yep, I have a 95 year old client whose broker is following her conservative risk tolerance but then purchased an oil and gas PTP. No way this woman would ever understand this investment; she hasn't even been able to recognize the 1099-SSA for the last 2 years and was in tears yesterday over the "lost" 1099 that she had all along after we requested a duplicate. She found it today.

-

No, only the label for line 9 is unclear to you. Perhaps it should read "contributions made through and by employment". The instructions for line 9 are very clear. It says this line should include all contributions made by the employer AND by employee through a cafeteria plan. When the employee contributes through a cafeteria plan offered by the employer, the employer has the funds and acts in the capacity of agent to remit those funds to the HSA on behalf of the employee.

-

There's a current discussion in the Drake subforum here that touches on it. It works well, but there is no confirmation number or record without logging onto the IRS account or verifying through bank activity. I've used direct pay for the balance due but not for estimates. I really don't want that level of responsibility for clients' payments.

-

I really don't want to be responsible for client's payments, but I had done it for one client for a few years that wanted it. I also did it one time for the 2022 return for a long time older client who is so disorganized that the return wasn't filed until Nov of last year, and I knew that the balance due may not be made. I also have trouble getting him to bring me or send me the notices he receives. I strongly nudged him in the direction of allowing me to schedule the payment for him.